Synchronize Trades, instantly

Manually tracking trades and recalling your reasoning is exhausting. Journalyze simplifies this with instant synchronization, making the process quick and seamless.

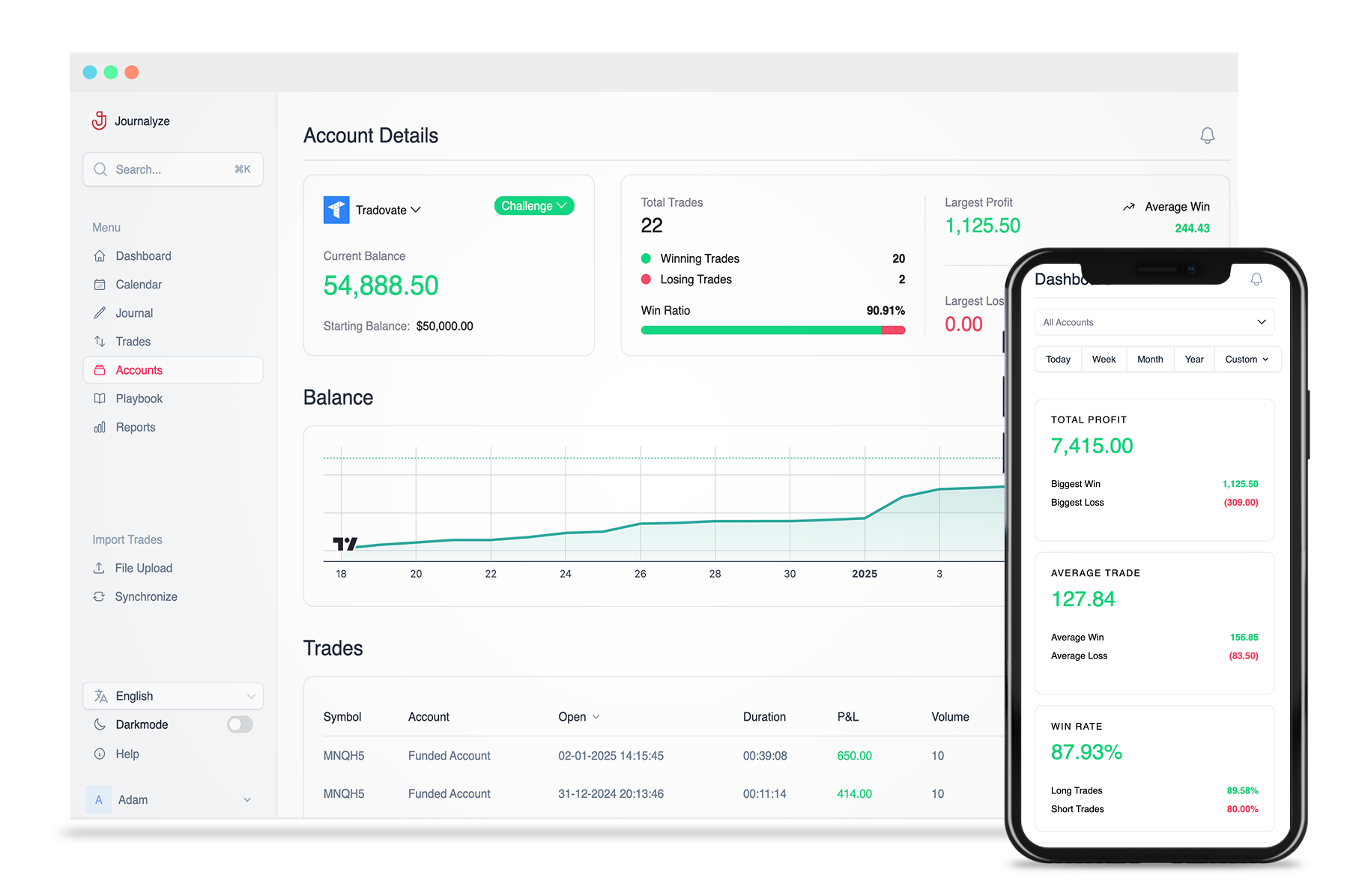

Journalyze is your ultimate online trading journal, designed to enhance your trading performance effortlessly.

Effortlessly track trades with instant sync, powerful analytics, and screen recording—designed specifically to elevate the performance of prop traders and futures professionals.

Manually tracking trades and recalling your reasoning is exhausting. Journalyze simplifies this with instant synchronization, making the process quick and seamless.

Tag your trades effortlessly with Journalyze to uncover patterns, refine strategies, and focus on what drives your success.

Screen recording lets you replay trades, analyze your decisions, and uncover insights to sharpen your strategy.

Journalyze is built for prop traders and futures professionals. We support the most popular trading platforms to help you track your trades effortlessly.

Tradovate

NinjaTrader

MetaTrader 5

Rithmic Trader (Pro)

MetaTrader 5

ATAS

Topstep

Apex Trader Funding

earn2trade

Apteros Trading

My Funded Futures

Funded Futures Family

UProfit

One Up Trader

“Journalyze has simplified journaling in more ways than one. From tracking my trades to honing my edge, it's become my go-to tool for my trading reviews.”

Designed for traders at all levels, our plans deliver the tools you need to succeed.

Clarity starts here: Dive into our FAQs.

Journalyze uncovers hidden patterns in your trades, pinpoints costly mistakes, and highlights what’s working. By delivering actionable insights, it helps you eliminate bad habits, sharpen your strategies, and maximize your profitability—turning frustration into consistent growth.

Yes, our software supports multiple trading accounts, making it easy to manage and analyze trades from different accounts in one place.

Absolutely! Journalyze was specifically designed with prop traders in mind, ensuring seamless integration with most prop trading firm platforms. It streamlines your trade journaling process, so you can focus on what really matters—becoming a profitable trader.

You can import your trade data via supported file formats, API integrations, or manual entry, depending on your broker’s compatibility.

Our software uses advanced analytics to generate detailed charts, summaries, and metrics that help you track performance trends and optimize your strategies.

Yes, our dedicated support team is here to help via email or live chat, ensuring you have a smooth experience.

Our journal automates data entry, offers in-depth analysis, and provides unique features tailored for prop traders and futures traders, all while ensuring a user-friendly experience.